In the ever-evolving landscape of personal finance, having the right tools at your fingertips can make a significant difference. As we step into 2024, Android users have access to a plethora of finance apps that cater to budgeting, investing, expense tracking, and more.

This comprehensive guide explores the top 10 finance apps for Android in 2024, delving into their features, usability, and how they empower users to take control of their financial well-being.

Don’t Miss: Top 10 Best Entertainment Apps

About Finance Apps on Android

Finance apps on Android serve as virtual financial assistants, helping users manage their money, save, invest, and stay on top of their financial goals. From providing real-time expense tracking to offering insights into investment portfolios, these apps offer a diverse range of functionalities to suit various financial needs.

Types of Finance Apps

Budgeting and Expense Tracking Apps

Budgeting apps help users set financial goals, create budgets, and track their expenses in real time. Examples include Mint, YNAB (You Need A Budget), PocketGuard, and Expensify.

Investment and Trading Apps

For those interested in growing their wealth, investment and trading apps offer a platform to buy and sell stocks, manage portfolios, and stay updated on market trends. Notable choices include Robinhood, E*TRADE, Fidelity, and Acorns.

Banking Apps

Modern banking apps provide a range of services beyond traditional banking, including mobile check deposits, transaction history tracking, and account management. Examples include Chime, Ally Bank, Simple, and N26.

Personal Finance Management Apps

Comprehensive personal finance management apps offer a holistic view of one’s financial situation, combining budgeting, investment tracking, and banking features. Options include Quicken, Personal Capital, Moneydance, and Tiller Money.

Top 10 Best Finance Apps

1. Mint: Budget, Bills, Finance

Mint is a powerhouse in the finance app realm, offering comprehensive budgeting tools and expense tracking. It syncs with bank accounts and credit cards to provide a holistic view of your financial landscape.

Features:

- Automated expense categorization.

- Bill tracking and payment reminders.

- Credit score monitoring.

- Goal setting for savings.

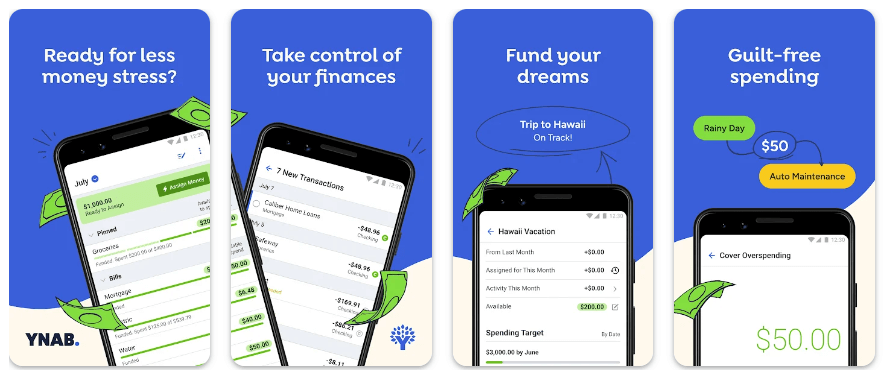

2. YNAB (You Need A Budget)

YNAB focuses on the principle of giving every dollar a job. It’s a zero-based budgeting app that encourages users to allocate every dollar towards a specific purpose, ensuring a proactive approach to spending.

Features:

- Rule-based budgeting.

- Goal tracking for savings.

- Educational resources on budgeting.

- Bank syncing for real-time data.

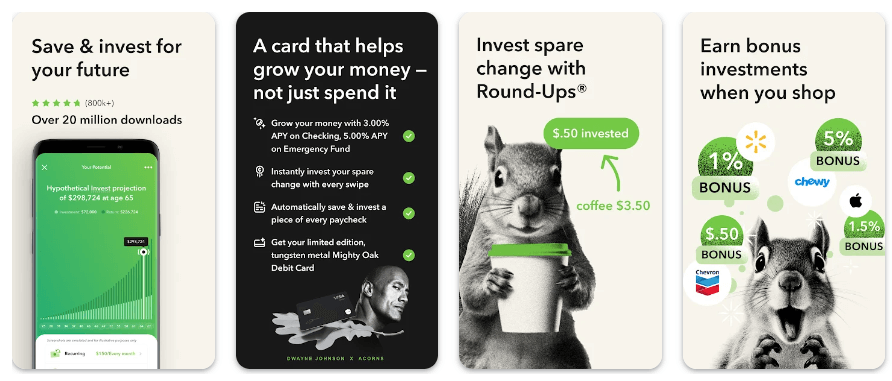

3. Acorns: Invest Spare Change

Acorns is an innovative app that rounds up your everyday purchases to the nearest dollar and invests the spare change. It’s an excellent option for users looking to start investing in small amounts.

Features:

- Automated micro-investing.

- Portfolio customization.

- Found Money feature for cashback.

- IRA and retirement account options.

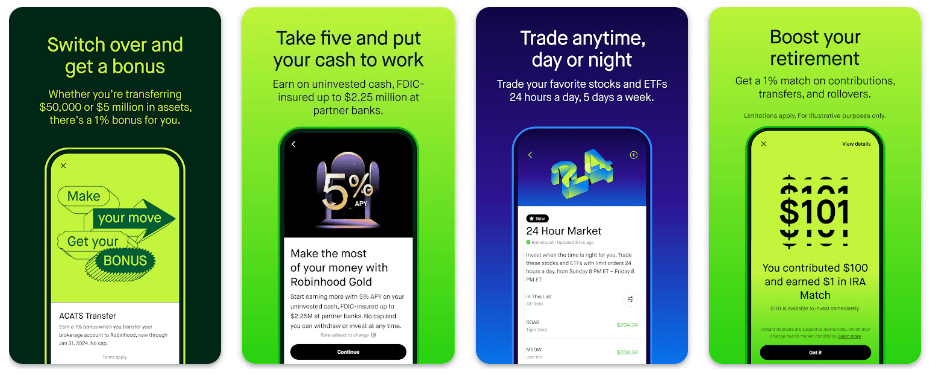

4. Robinhood: Investing, Stocks, ETFs

Robinhood revolutionized the investing world with its commission-free trading platform. It allows users to invest in stocks, ETFs, options, and cryptocurrencies without paying traditional brokerage fees.

Features:

- Commission-free trading.

- Fractional share investing.

- Cryptocurrency trading.

- Stock and market news updates.

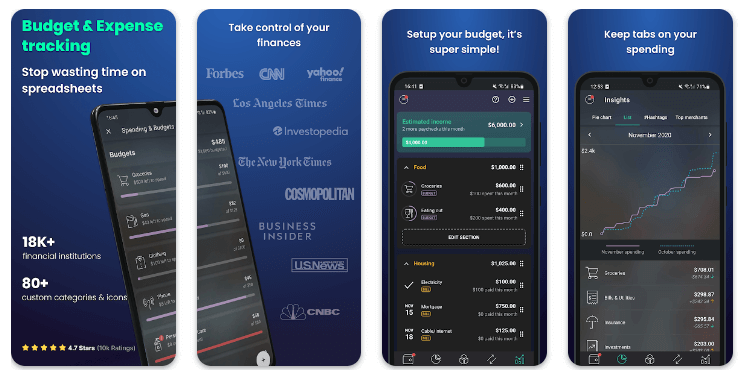

5. PocketGuard: Personal Finance, Money & Budget

PocketGuard is a user-friendly budgeting app that provides a clear overview of your financial situation. It analyzes your spending patterns, tracks bills, and offers suggestions to optimize your budget.

Features:

- Automated budget categorization.

- Bill tracking and due date reminders.

- Goal setting for savings.

- In-app spending analysis.

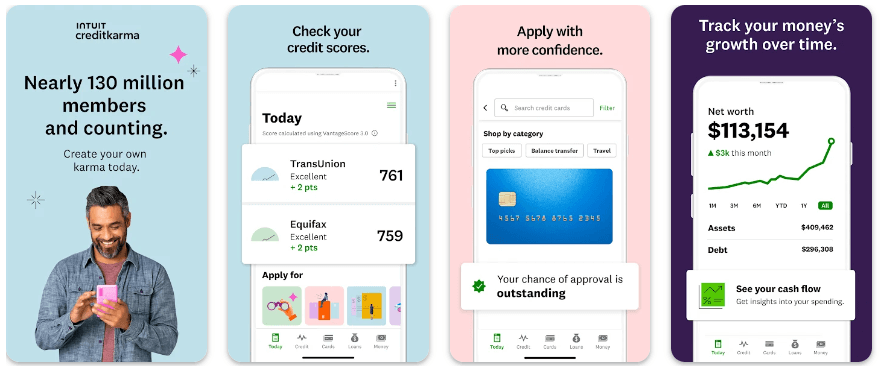

6. Credit Karma: Credit Score & Reports

Credit Karma is a comprehensive app that not only provides free credit score monitoring but also offers insights into your credit report. It helps users understand and improve their credit health.

Features:

- Free credit score tracking.

- Credit report monitoring.

- Personalized financial recommendations.

- Credit score simulators.

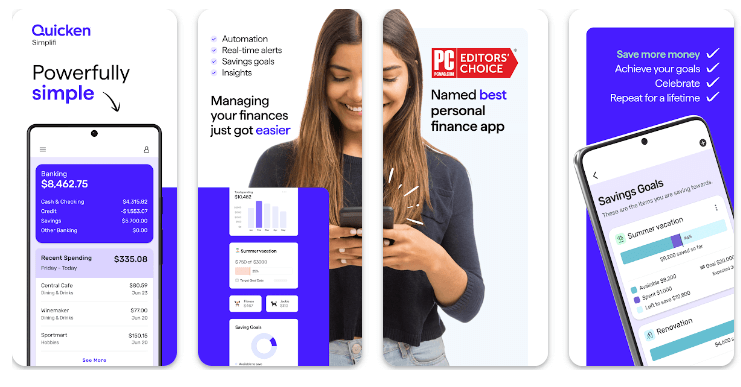

7. Simplifi: Budget, Bills, Money

Simplifi by Quicken is designed for users who seek simplicity in managing their finances. It offers budgeting tools, expense tracking, and insightful reports to help users make informed financial decisions.

Features:

- Automated expense categorization.

- Bill tracking and payment reminders.

- Budget customization.

- Real-time spending alerts.

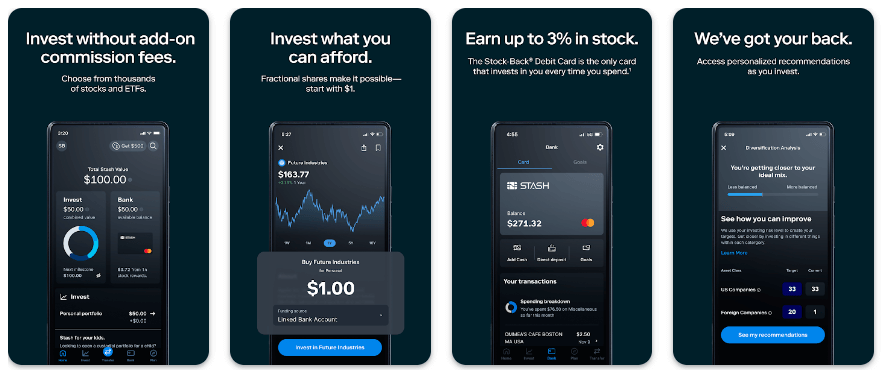

8. Stash: Invest. Learn. Save.

Stash combines investing with financial education, making it an excellent choice for beginners. Users can start investing with as little as $5 and choose from a variety of themed investment portfolios.

Features:

- Fractional share investing.

- Educational content on investing.

- Automated saving and investing.

- Retirement account options.

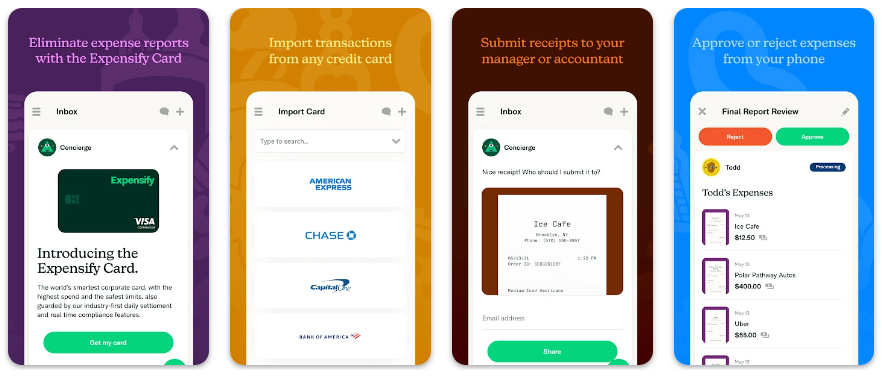

9. Expensify: Receipts & Expenses

Expensify is a powerful tool for expense tracking, particularly for business expenses. It simplifies the process of capturing receipts, tracking mileage, and generating expense reports.

Features:

- Receipt scanning and capture.

- Mileage tracking.

- Expense report generation.

- Integration with accounting software.

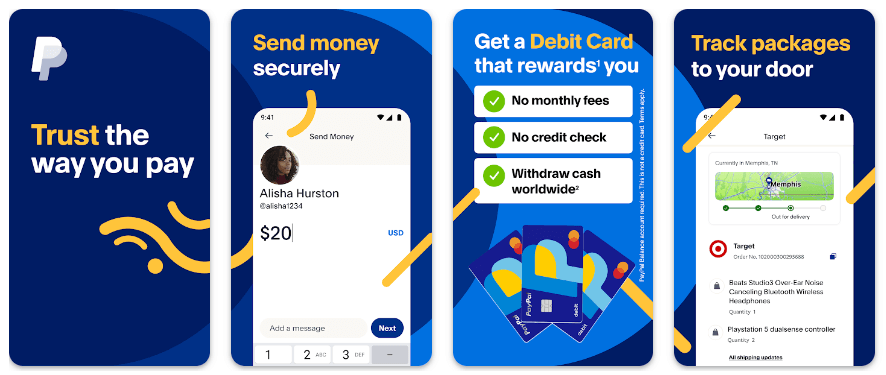

10. PayPal: Mobile Cash

While primarily known for online transactions, PayPal’s mobile app extends its functionality to personal finance. It allows users to manage their money, send and receive funds, and even invest.

Features:

- Fund transfers and payments.

- Mobile cash deposits.

- Investing in stocks and cryptocurrencies.

- Budgeting tools.

How To Use Finance Apps?

Using finance apps can help you manage your money more efficiently and stay on top of your financial goals. Here’s a general guide on how to use finance apps effectively:

Choose the Right App:

There are various finance apps available, each catering to different needs. Some focus on budgeting, others on investing, and some on tracking expenses. Choose an app that aligns with your financial goals.

Set Up Your Accounts:

Most finance apps require you to link your bank accounts, credit cards, and other financial accounts. Follow the app’s instructions to securely connect your accounts.

Budgeting:

Create a budget within the app by categorizing your income and expenses. Many apps offer customizable categories, allowing you to track specific spending patterns.

Expense Tracking:

Regularly input your expenses into the app. Some apps can automatically categorize transactions, while others may require manual input. Review your transactions to ensure accuracy.

Notifications and Alerts:

Turn on notifications and alerts to receive updates on your account balances, upcoming bills, or when you’re nearing your budget limits. This helps you stay informed and avoid overspending.

Saving Goals:

If the app has a goal-setting feature, use it to set savings targets. Allocate a portion of your income towards specific goals like an emergency fund, vacation, or major purchase.

Debt Management:

If you have loans or credit card debt, use the app to track and manage these obligations. Some apps offer advice on debt reduction strategies.

Investment Tracking:

If you’re using the app for investment purposes, regularly review your investment portfolio. Some apps provide market news, performance analytics, and investment recommendations.

Credit Score Monitoring:

Some finance apps offer credit score monitoring. Check your credit score regularly and take steps to improve it if necessary.

Security Measures:

Implement security features such as two-factor authentication to protect your financial information. Use strong, unique passwords for your accounts.

Regular Check-Ins:

Set aside time each week or month to review your financial data in the app. This helps you stay aware of your financial situation and make necessary adjustments.

Explore Additional Features:

Many finance apps offer additional features like bill pay, receipt tracking, and financial reports. Explore these features to see if they can further streamline your financial management.

Educate Yourself:

Familiarize yourself with the app’s features and settings. Many finance apps provide educational resources to help you improve your financial literacy.

Remember to update the app regularly to access the latest features and security enhancements. Using finance apps consistently and staying proactive in managing your finances can contribute to better financial health.

Downloading and installing the games on both Android and iOS devices is a straightforward process. Here’s a step-by-step guide for each platform:

For Android:

- Open the Google Play Store

- Search for the app

- Select the app

- Download and Install

- Launch the app

For iOS:

- Open the App Store

- Search for the app

- Select the app

- Download and Install

- Wait for Installation

- Launch the app

FAQs

1. Are these finance apps secure to use on Android?

Yes, these finance apps prioritize user security and employ encryption measures to protect sensitive financial information. It’s advisable to use official app stores for downloads to ensure authenticity.

2. Do these apps charge fees for their services?

Many of the listed apps offer free versions with basic features, but some may have premium versions or in-app purchases for advanced functionalities. Users can choose based on their needs.

3. Can these apps sync with multiple bank accounts?

Yes, most finance apps allow users to sync with multiple bank accounts and credit cards to provide a comprehensive overview of their financial situation.

4. Are these apps suitable for both beginners and experienced users?

Yes, these apps cater to users with varying levels of financial knowledge. They often provide educational resources for beginners and advanced features for experienced users.

5. How frequently are these apps updated?

Finance apps are typically updated regularly to introduce new features, enhance security, and address any bugs or issues. Users are encouraged to keep their apps updated for the best experience.

Conclusion

In the dynamic world of personal finance, the right app can be a game-changer. The top 10 finance apps for Android in 2024 cater to a range of financial needs, from budgeting and expense tracking to investing and credit score monitoring.

Whether you’re a seasoned investor or just starting to take control of your finances, these apps offer the tools and insights you need for financial success.